Resident Screening

Powered by Western Reporting

Screening doesn’t have to be complex. With ResidentIQ® Screening, you can easily screen prospective residents and receive fast, accurate data, and configurable reports so you can make informed leasing decisions.

Fast, Accurate Resident Screening

Healthier Communities

& Better ROI

Your rental investment depends on the quality of your residents. Communities that use our resident screening software report the highest rates of retention and the lowest rates of turnover in their respective markets.

ResidentIQ Resident Screening provides you with the tools needed to impartially analyze reports efficiently using your specific set of parameters. Your investment needs to be protected and our powerful decision-making tools integrate with multiple PMS solutions to provide customers with a seamless experience.

Credit Reports

We have partnered with major credit reporting agencies to provide comprehensive credit reports including bankruptcy information, delinquent accounts, credit history, public records, trade lines and debt-to-income ratios.

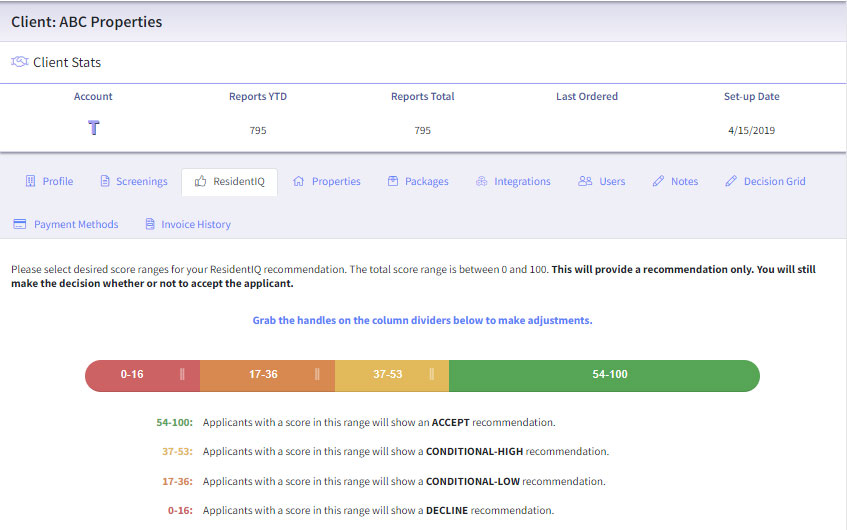

Our configurable predictive scoring model is designed to assess ability and willingness to pay. This model supports all multifamily asset types and allows screening criteria, score thresholds and workflows to be configured at a property level

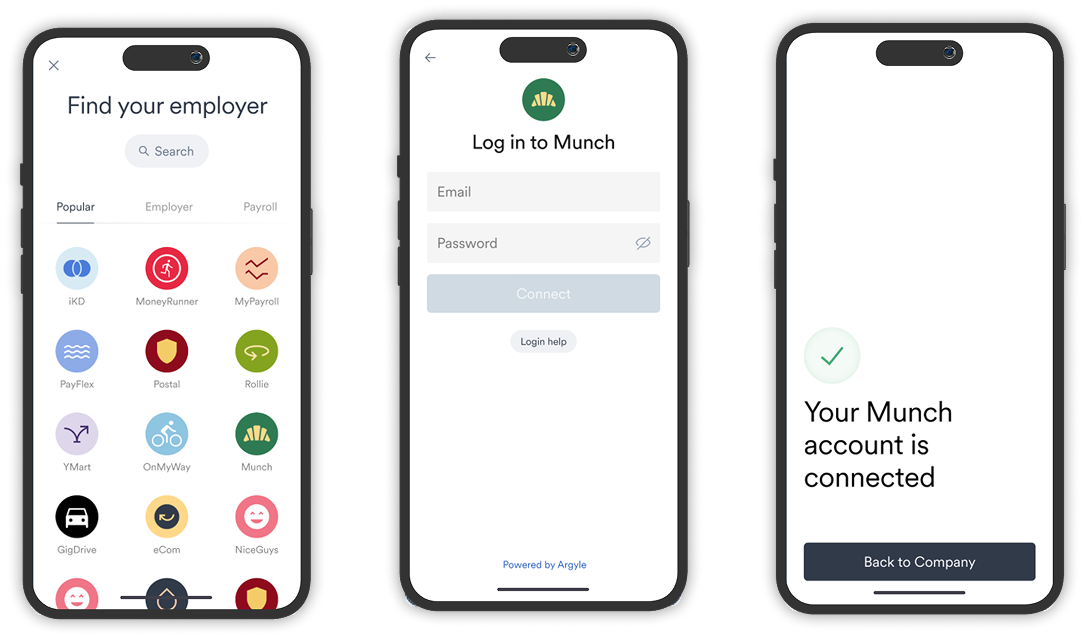

Digital Income Verification

Digital Income Verification streamlines the

lease approval process by allowing renters to

connect directly to their payroll system to validate

income. Results – including the calculated rent to

income ratio – are returned directly in the

screening report, saving property teams time,

reducing errors and providing a better experience

for renters.

Features & Functionality

ResidentIQ offers more than a traditional screening software!

See How The Power of Choice™

Can Solve What Matters to You.

Design your residential tech stack today.